New Incentives Got You Revved Up to Electrify Your Ride?

Rivian All-Electric Truck on display by C3 supporters at the Party for the Planet

The Inflation Reduction Act (IRA) signed into law last year opened doors for climate action in a big way, including offering significant tax credits for the purchase of new and used electric vehicles. In this blog, Make Your Own Impact campaign leader Teri Strother shares what we know and some helpful links.

If you’re among the 1 in 4 Americans who say they are looking to make their next vehicle electric, it’s important to know the ins and outs of the federal tax credit that went into effect January 1, 2023. It’s not necessarily an easy ride, pun intended. It’s complicated and nuanced.

First, you MUST do your homework on this!

The law is complex, so read articles (I put a few of my favorites at the end of this article) and talk to the experts – your tax accountant, lawyer, or local auto dealer – about what vehicle you can qualify for. Remember we at C3 are here to help.

Any reason I should buy now? Well, in March the rules will change

The Department of Treasury is still deciding on the rules around the sourcing of critical components. It’s possible the vehicle you want now won’t make the list. We just don’t know.

Tax Credit for NEW Electric Vehicles

Okay. Let’s start with new vehicles. Here’s what you should know:

IRA law extends $7,500 tax credit for EVs and hybrids. The federal government continues to update the list of qualifying vehicles.

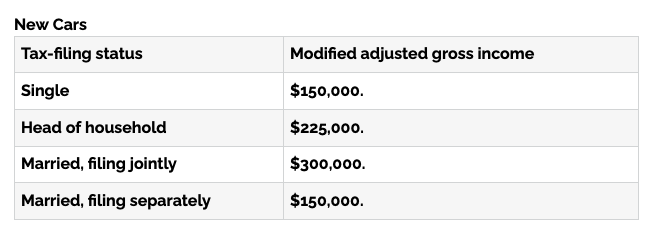

Check the income caps

Cap removed for car manufacturers! GM, Tesla, and others used to be on a 200,000 limit. The cap has been lifted.

There is a cap on price of the vehicle. The price cap for cars is $55,000 and for trucks, SUVs, and vans it’s $80,000. Check the list – the line between SUV and car is sometimes blurry, folks! Note: add-on features could tip you over the value limit.

There are new rules on manufacturing locations and battery components

To be eligible for the new credit, vehicles must have had final assembly in North America. Find the vehicle identification number (VIN) and check the National Highway Traffic Safety Administration’s VIN database to see the car’s final assembly details.

The tax credit is divided into two parts – battery requirements and critical minerals requirements.

To be eligible for the battery portion of the credit (up to $3,750), a certain percentage of the vehicle’s battery must be assembled in the U.S., Canada, or Mexico. Note: this will get stricter each passing year for the next ten years (i.e. the percentage of assembly or manufacturing in North America will go up each year. By 2029-2032 100% of the assembly will be required to take place in North America)

To receive the rest of the $3,750 credit, cars must meet a "critical minerals requirement". This requires that a certain percentage of critical minerals in the car's battery be extracted or processed within the U.S. or within a country with whom the U.S. has a free-trade agreement. This will also get stricter each passing year (i.e. by 2027-2032 80% of the minerals will need to be extracted in the US or with a country with whom we have a free trade agreement).

Cars with Chinese-made battery components are ineligible.

Electric Vehicle Owners’ Rally in 2021 Hosted by Inbio

Tax Credit for USED EVs and Hybrids

Next up, let’s go over used electric vehicles and hybrids. For the first time, the federal government has a tax credit for USED EVs and Hybrids!

Used electric vehicles and hybrids are eligible for up to $4,000 federal tax credit (10 years avail until 2032)!

Check the income caps

Price matters: Cars need to be under $25,000

Other rules:

Used cars must be two years old.

The vehicle must be purchased at a dealership.

The vehicle only qualifies once in its lifetime. Subsequent owners will not be eligible.

Purchasers of used vehicles can only qualify for one federal tax credit every three years.

Purchaser can’t be claimed as a dependent.

******

What about leased vehicles? It’s still unclear if they qualify - talk to a dealer! C3 has partnered with Carter Meyers Automotive since our founding, including their membership in the Green Business Alliance — so give them a shout.

How to claim the credit?

Fill out IRS form 8936

You’ll need the VIN. You can reference the National Highway Traffic Safety Administration’s VIN database to check out a car’s final assembly details.

Do I have to wait for the tax credit?

In 2023, yes. But in 2024 there may be a point-of-sale rebate so you won’t have to wait. We’ll cross that bridge when that happens!

Don’t forget

Do your homework! Check the IRS website for the most up-to-date information. If you want to hear a radio version of this content, check out my interview with Charlottesville Right Now’s Courteney Stuart last week on WINA Newsradio.

Hope that helps,

—Teri

My TOP TEN favorite links on this topic

1- Plug-In-America: (I watched the webinar - super informative and worth the watch!)

https://pluginamerica.org/policy/what-you-need-to-know-about-2023-ev-tax-credits/

2- Keith Barry from Consumer Reports: https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in-hybrids-that-qualify-for-tax-credits-a7820795671/

Author with her leased Nissan Leaf and her son - crossing fingers tax credit will apply to leased vehicles!

3- Consumer Reports: Rules Will Change in March:

4- Kiplinger article:

https://www.kiplinger.com/taxes/605081/ev-tax-credit-inflation-reduction-act-2022-changes

5- Alternative Fuels Data Center - EVs for tax credit list: https://afdc.energy.gov/laws/electric-vehicles-for-tax-credit

6- IRS list of qualifying vehicles page: https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

7- Tax credit for EV chargers:

https://www.kiplinger.com/taxes/605201/federal-tax-credit-for-electric-vehicle-chargers

8- Database to find all federal and state laws and incentives:

https://afdc.energy.gov/laws/search

9- Nerd wallet article:

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric-vehicle-tax-credit

10- Kelly Blue Book article:

https://www.kbb.com/car-advice/how-do-electric-car-tax-credits-work/

11- Edmunds article:

https://www.edmunds.com/fuel-economy/the-ins-and-outs-of-electric-vehicle-tax-credits.html