How Will the New Climate Law Help Virginia Households?

This is part three of our blog series about the implications of the historic climate legislation, the Inflation Reduction Act. Here, our Director of Communications Teri Kent breaks down how Virginia households will benefit from the new climate law.

After decades of failed attempts at the federal level to act on climate, the biggest climate bill in history—the Inflation Reduction Act (IRA)—has been signed into law. The IRA will inject 370 billion dollars in climate actions aimed to decrease our CO2 emissions by 40% by 2030, help consumers save on energy costs, and propel the US to becoming a clean energy industry leader.

All of this is critical to fighting climate change, but what does the IRA mean for Charlottesville individuals and families? Will the IRA help homeowners and renters with their rising energy costs? Will it help families take action to reduce their carbon footprint that has been on hold due to uncertainty and budget constraints amidst rising inflation? I answer a resounding YES.

The Inflation Reduction Act will help Virginia households make improvements to their homes, which is critical for reducing emissions from the residential sector. In this blog, I list some key reasons you can toast to the bill’s passage and jumpstart your next climate action move!

This legislation includes 10 years of tax credits and rebates to install all kinds of clean residential and vehicle technologies – from rooftop solar to heat pumps to high-efficiency appliances and electric vehicles, all of which will help individual consumers save money while reducing their impact. Put together, these energy efficiency projects, solar installations, and EV adoptions could save American households thousands of dollars — over $20,000 if you qualify to take full advantage!

Ben Evans, federal legislative director of the US Green Building Council had this to say in a recent article from Wired.com about the law: “It’s basically just a big green light for everyone—for the consumer, for the companies making these products, for building owners, for utilities, everybody—to start doing this stuff. And we think that’s really going to change these markets. I don’t think it’s an overstatement to call this historic.”

Though the exact implementation of the laws and the so-called “fine print” is still in the works, there’s plenty of good news to share. Let’s dive into some of the details of what we know:

Susan Kruse, C3’s Executive Director electrified her home in 2020

Energy Efficiency and Electrification Home Improvements

Energy Efficiency Rebates and Tax Credits

We know energy efficiency is a common-sense, yet sometimes neglected climate solution. Research from ACEE revealed that we could reduce our emissions by 50% by 2050 with energy efficiency alone. We also know that 80-90% of homes in the U.S. have inadequate insulation, and according to the National Renewable Energy Laboratory’s Virginia Fact Sheet, Virginia single-family homes stand to save 28% on energy with cost-effective improvements.

So there’s a good chance there’s something every home could do in the next ten years to capitalize on these rebates and tax credits, and at the same time drive down our emissions.

Federal Tax Credits

Here’s what on tap for tax credits:

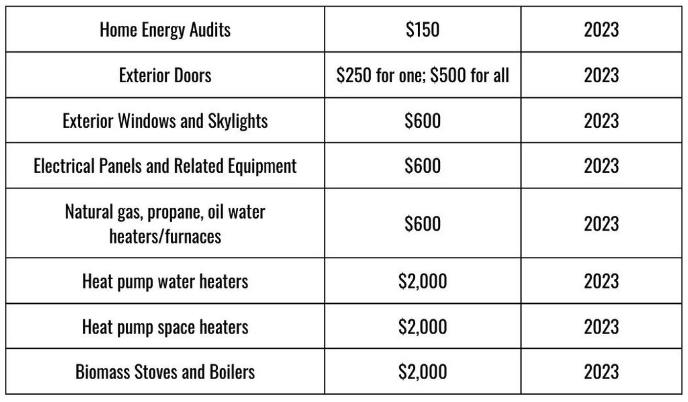

Previous tax credits allowed for a 10% tax credit up to $500 for your lifetime. Now it’s 30% of purchases every year up to $1,200 starting in 2023 going through 2032. So you could insulate this year, tackle better windows next year, and on and on over the next ten years.

The exception is heat pump water heaters and heat pump space heaters. That earns a $2,000 tax credit.

See the summary chart below:

Rebates - High Efficiency and Electric Homes Rebate Act (HEEHRA)

Qualifying households can use up to $14,000 in rebates for appliances and energy efficiency upgrades over the next ten years. Qualifying households are defined in the law as individuals or families whose annual incomes are less than 80% of the area median or not greater than 150% of the median.

The lowest-income households are also eligible for point-of-sale rebates covering the full cost of certain electrical appliances or efficiency projects!

Author in front of one of her rooftop solar panels

Rooftop Solar and Geothermal

Homeowners can continue to claim a federal tax credit on solar panels, but now it’s back up to 30%. You can also claim a new credit on battery technology intended to store electricity from renewable sources.

Inbio’s EV Owner Rally 2021

Electric Vehicles

According to Consumer Reports, 36% Amercians want to make their next car purchase or lease electric. Yet, the sticker price and still emerging EV infrastructure for longer trips are significant barriers for many consumers. The IRA’s point-of-sale rebates should drive more EV adoption, with one caveat – there are stipulations that require the car to be manufactured in the US (at least for final assembly), and a portion of the minerals in the battery has to be mined or processed in the US or a country with a free-trade agreement. If you’re in the market, here’s a great resource I recommend bookmarking. So definitely do your homework or reach out to us and we’re happy to help!

Here’s the scoop:

For new EVs there’s a maximum credit of $7,500 in the bill, an extension of a previous incentive.

Then starting on January 1, 2024 through 2032, consumers can elect to take that money as a point-of-sale rebate, instead of claiming the credit on their taxes.

For used EVs, the tax credit is either $4,000 or 30% of the sale price, but the vehicle can’t cost more than $25,000.

Calculate your savings opportunity!

Rewiring America has a fantastic benefits calculator – check out: REWIRING BENEFITS CALCULATOR. Type in your name, zip code, and annual income, and it gives you a list of what you qualify for, when it takes effect, and how long you have to take advantage.

The wind is now at your back, and C3’s team stands ready to assist on getting some of those climate actions across the finish line. We at C3 can help with resources and one-on-one coaching. More details to come in 2023. Email impact@theclimatecollaborative.org if you’d like our help.

Let’s do this!

–Teri

Great Sources:

New as of 1/3/2023: Washington Post article “3 ways to tap billions in new money to go green — starting this month

New as of 12/30/2022: Federal government released an Inflation Reduction Act Guidebook for Clean Energy and Climate Programs.

C3 made this handout with the above charts on rebates and incentives that can also be found on the Make Your Own Impact page.

Hot Deals: A Consumer’s Guide to the New Climate Law - Politico

How the Huge New US Climate Bill Will Save You Money - Wired.com

Energy Efficiency Rebates and Tax Credits for 2023: New Incentives for Home Electrification - Solar.com

The Inflation Reduction Act and What It Means for America and You - Eco America

For those of you who want to further geek out on the legislation, check this out!

BY THE NUMBERS: The Inflation Reduction Act - The White House

FACT SHEET: Inflation Reduction Act Advances Environmental Justice - The White House

Inflation Reduction Act Summary: Energy and Climate Provisions - Bipartisan Policy Center

Excerpt from the White House Fact Sheet:

Lowering Energy Costs

$14,000 in direct consumer rebates for families to buy heat pumps or other energy-efficient home appliances, saving families at least $350 per year.

7.5 million more families will be able to install solar on their roofs with a 30% tax credit, saving families $9,000 over the life of the system or at least $300 per year.

Up to $7,500 in tax credits for new electric vehicles and $4,000 for used electric vehicles, helping families save $950 per year.